Retail media has cemented its position as a powerful advertising channel, allowing retailers to leverage their physical and digital spaces to engage shoppers with personalised and relevant ads.

As we look to 2025, retail media’s evolution shows no signs of slowing. Here are five key predictions that show how retail media networks (RMNs) will continue transforming.

PREDICTION #1

Revenue revolution: retail media’s multi-billion dollar surge

No surprises here; retail media is set to become a central revenue channel for retailers, projected to surpass $3.7 billion in Australia alone by 2028. This growth is driven by major retailers expanding in-store and digital media spaces and using their physical footprints to unlock untapped ad inventory. From aisle screens and digital displays to app banners and online placements, retailers are transforming these spaces into revenue-generating assets.

With this new untapped resource, brands can directly target consumers with relevant, contextual ads at critical moments. For retailers, this additional income stream allows them to reinvest in in-store experiences, online upgrades, and personalised customer services.

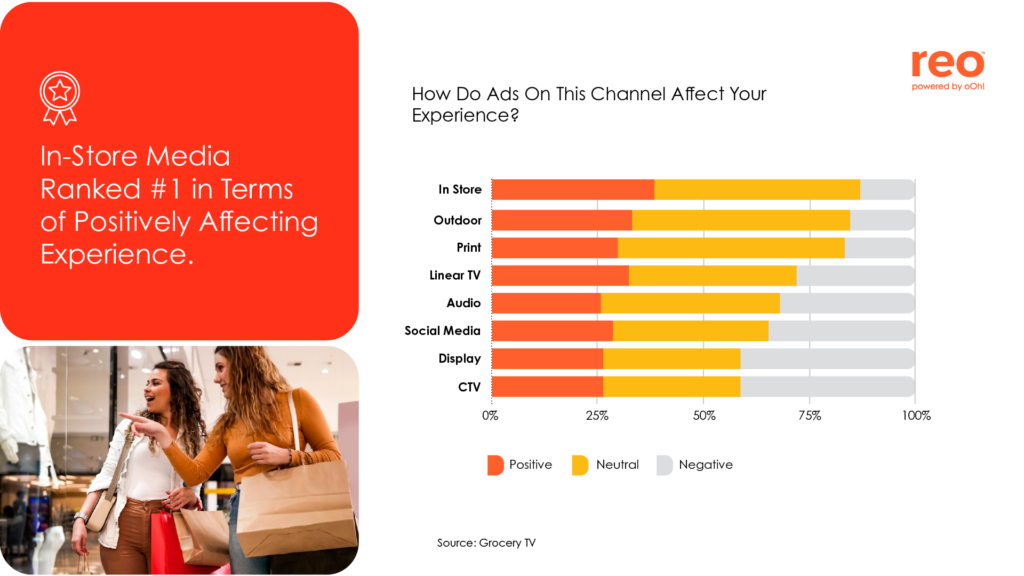

Positive consumer sentiment toward in-store advertising also boosts the value of these ad spaces. With 87% of consumers expressing acceptance or a positive attitude toward in-store media, retail media networks are in a unique position to capture a growing share of advertising dollars. When shoppers are already in a purchasing mindset, in-store ads feel more helpful than intrusive, enhancing the experience rather than interrupting it. This preference translates to increased advertiser interest and higher ad spend, further accelerating the retail media boom. As the channel’s effectiveness is proven and its reach grows, brands will be more inclined to allocate budgets toward retail media networks, unlocking even greater revenue potential for retailers.

PREDICTION #2

Omnichannel alchemy: blending in-store and online for seamless engagement

As omnichannel experiences become essential for modern retail, RMNs are advancing to create a unified, cohesive journey that seamlessly integrates in-store media with digital campaigns. This shift enables shoppers to experience relevant content across every touchpoint, whether through mobile ads that drive foot traffic, website promotions that reinforce in-store offers, or digital screens that bring online promotions to life right in the aisles.

A truly integrated omnichannel approach helps brands maintain consistency in messaging, which boosts brand recognition and reinforces purchase intent. Shoppers encounter the brand at every stage, creating familiarity and trust that makes them more likely to act when it’s time to buy. This approach helps bridge the gap between awareness, consideration, and purchase – strengthening engagement and driving conversions as consumers transition smoothly between online browsing and in-store decision-making.

As consumers increasingly expect convenience, personalisation, and seamless interactions, this integration empowers retailers to capture and retain their attention. In a market where competition is fierce, a refined omnichannel strategy positions brands as innovative, responsive, and in tune with their audience’s preferences. By aligning digital, out of home (OOH) and in-store media, retailers not only enhance the shopping experience but also build loyalty and stay competitive in an evolving retail landscape.

PREDICTION #3

First-party data treasures: retailers’ secret to targeting gold

With third-party cookies on their way out, retailers’ first-party data will be the backbone of RMN success, providing brands with invaluable insights into shopper preferences, behaviours, and purchasing patterns. Using data from loyalty programs, purchase history, and browsing behaviour, retailers can empower brands to deliver highly personalised, meaningful ads in ways that also prioritise consumer privacy. This shift towards first-party data ensures that ads are not only targeted effectively but also compliant with global privacy standards, as retailers align their practices with growing regulations like the GDPR and CCPA.

Consumers increasingly value relevance and control, and first-party data provides brands with a powerful tool for meeting these demands. With 86% of Australian consumers preferring ads that match the content they’re viewing, this reliance on first-party insights enables brands to deliver the right messages at the right time, enhancing engagement and boosting brand trust. Targeted ads informed by real purchasing data are not only more impactful but also help deepen the connection between brands and consumers. This alignment with consumer sentiment is crucial for conversion, as ads feel more natural and less intrusive, resulting in a positive, trust-based experience.

By embracing first-party data, RMNs can create a powerful cycle of relevance, compliance, and effectiveness that benefits both retailers and brands, reinforcing consumer trust and increasing the impact of campaigns in a cookie-free future.

Introducing reo: helping retailers build & monetise their retail media networks

reo partners with retailers to build best-in-class, omnichannel retail media networks that unlock incremental revenue opportunities for Australia and New Zealand’s leading retail brands, in the fastest-growing advertising channel – retail media.

PREDICTION #4

Power partnerships: retailers and brands join forces for growth

In 2025, strategic partnerships between retailers and brands will expand significantly, leveraging shared insights and co-branded initiatives to boost engagement, streamline campaigns, and deliver seamless shopping experiences. As retail media networks mature, brands will collaborate closely with retailers on campaign data, enhancing the relevance and effectiveness of their messaging. Together, they’ll craft targeted experiences that align with consumer preferences, leveraging data from loyalty programs, purchase patterns, and browsing behaviours. This level of partnership is about more than just ad placement; it’s about shaping campaigns that resonate with customers at key moments, influencing both intent and conversion.

Co-branded campaigns, particularly around high-traffic seasons and limited-time offers, will further strengthen customer loyalty by addressing shoppers’ immediate needs. During the back-to-school season, for instance, brands could gain insights into trending items, enabling them to optimise inventory and craft messaging that resonates with shoppers during peak periods. This collaborative approach helps retailers refine product placements and promotions while helping brands tailor their messaging to consumer demand.

Retailers can also amplify brand campaigns running on traditional channels by integrating them into their RMNs, bridging the gap between digital and physical experiences. For instance, brands with TV or radio ads can create a seamless shopper experience by mirroring key visuals, messages, and offers across in-store digital displays, aisle screens, and online banners within the retailer’s ecosystem. This cohesive presence reinforces brand recognition, making campaigns more memorable and impactful for shoppers who may have encountered the brand on traditional media.

By aligning in-store media with broader campaigns, retailers can also leverage their unique insights into shopper behaviours to optimise the reach and relevance of these campaigns. For example, if a brand’s product is promoted on TV, in-store displays can direct customers to where they can find that product in the store, and even highlight related items. This synchronisation not only increases engagement but can drive sales conversion by guiding customers directly from awareness to action in a single shopping journey.

PREDICTION #5

Tech talent rush: Investing in people and platforms for retail media success

With retail media networks (RMNs) rapidly expanding, Australian retailers are navigating unique challenges in securing the tech and media talent needed to support this shift. The demand for professionals skilled in managing, measuring, and optimizing RMN channels is high, but the local talent pool remains limited. As RMNs evolve into core revenue drivers, retailers must carefully consider whether to build capabilities in-house or rely on specialised external resources.

Outsourcing RMN management can provide immediate access to media expertise and cutting-edge technology without the need for extensive in-house hiring. These partnerships offer scalable solutions such as dynamic ad placement and real-time data capabilities, empowering retailers to optimise campaigns efficiently. Additionally, outsourced teams can support closed-loop attribution tracking, from ad exposure to final purchase, offering clear insights into ROI for retail media efforts. This approach lets retailers tap into sophisticated audience segmentation tools, customer data platforms (CDPs), and real-time bidding technology to enhance shopper engagement with precision.

Retailers are also stepping up investments in advanced ad tech platforms to support these efforts. A robust tech stack that includes cross-channel tracking and personalised ad solutions helps create a seamless experience across digital and physical touchpoints, which is essential for a cohesive omnichannel strategy. These investments not only enable high-impact RMN initiatives but also ensure that retailers remain competitive, agile, and responsive in a fast-evolving digital landscape.

For many, a hybrid approach that combines in-house strategy with outsourced media execution can be the most effective path. This model lets retailers manage their strategy and first-party data internally while leveraging specialized partners for media execution and tech integration. By balancing internal and external resources, retailers can respond to market changes more flexibly and drive measurable value across their retail media assets.

BONUS PREDICTION

Full-funnel momentum – RMNs take on the upper funnel

landscape is evolving, with RMNs expanding to include mid– and upper-funnel ad opportunities. This shift enables brands to tap into first-party data for brand awareness and consideration campaigns, engaging shoppers earlier in their journey. By offering ad placements that reach audiences during the discovery phase, RMNs create a more comprehensive, top-to-bottom presence in the consumer decision-making process.

This expansion has significant implications for long-term brand awareness and growth. Full-funnel RMN solutions ensure that brands stay visible and relevant across various stages of engagement, nurturing recognition and trust that build up to conversions. Retailers and brands can now tailor their campaigns more strategically, using top-funnel ads to attract new audiences while deploying mid- and lower-funnel ads to convert these audiences into loyal customers. This level of customisation not only increases engagement but also strengthens market presence and lifetime value, turning each stage of the funnel into a cohesive, connected brand experience.

By moving up the funnel, RMNs unlock new potential for brands, combining the precision of first-party data with the flexibility to address various consumer intents. This approach makes retail media networks a powerful tool for both immediate sales impact and sustainable growth in a competitive digital advertising landscape.

Retail media networks are rapidly shaping the future of advertising in Australia and New Zealand, and 2025 promises even more transformation. As RMNs move beyond conversions, prioritise in-store media, capitalise on first-party data, and expand through strategic partnerships, they’re opening new possibilities for brands and retailers alike. Now is the time to act: retailers, brands, and tech partners that prepare now—investing in tech, refining strategies, and building powerful partnerships—are positioned to lead in this fast-evolving market.

Ready to tap into the momentum of retail media? Whether you’re a brand looking to reach customers more meaningfully or a retailer aiming to drive revenue, aligning your approach to these emerging trends will keep you ahead. Reach out to the reo team today; no matter how far along your retail media network journey you are, the team are here to help.

Ready to take your retail advertising to the next level?

Reach out to the team today: